At Clariness, we want to know what matters most to our clients. We don’t make assumptions about their patient recruitment needs, but instead we ask them directly. More importantly, we listen to the answers.

Take our recent Industry Leadership Initiative as an example of our dedication to meeting client needs. As part of an online survey, we asked stakeholders in clinical research 55 questions to gain insights into:

- The support they need to facilitate patient recruitment

- What they perceive as valuable assistance with patient recruitment

- What industry leadership in patient recruitment means

- What innovation in patient recruitment means

A total of 812 responses were obtained from clinical trial site investigators with industry compromising sponsors, contract research organizations (CROs), and vendors.

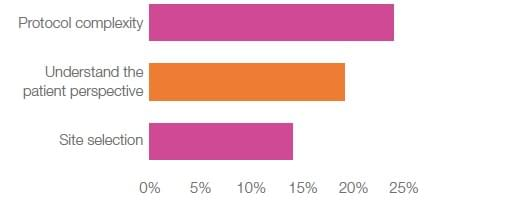

So, what are the biggest patient recruitment challenges faced by industry and investigators? Protocol complexity is the biggest challenge by far – unanimously reported across industry (Figure 1) and a challenge shared by investigators.

Another challenge for industry is site selection for sponsors and lack of budget for CROs, which compares to decreased patient interest for investigators.

In terms of lack of budget, out of those industry respondents with buying decision-making power, a significant proportion have no budget for patient recruitment strategies. Those with a patient recruitment budget have minimal funds for this critical component of successful clinical trials, with the largest portion of trials only having $0.5 million. Less than 1 in 10 trials had more than $2 million for patient recruitment.

Figure 1. Major challenges to patient recruitment for industry

A critical finding is that across all industry groups, the challenge to understand the patient perspective ranks as the second biggest recruitment challenge (Figure 1). At the same time, respondents want to understand the patient perspective in efforts to incorporate patient-centricity into the design of their clinical trial recruitment strategy. Indeed, patient-centric recruitment design was ranked as the most cost-effective recruitment strategies, despite the lack of budget provided for patient recruitment.

Building in patient-centricity doesn’t only have benefits for patients and for recruitment. A patient-centric trial is closer to real-world experience. This will generate the kind of real-world data and real-world evidence that the regulatory authorities seek, and that provides a good basis for sales and marketing.

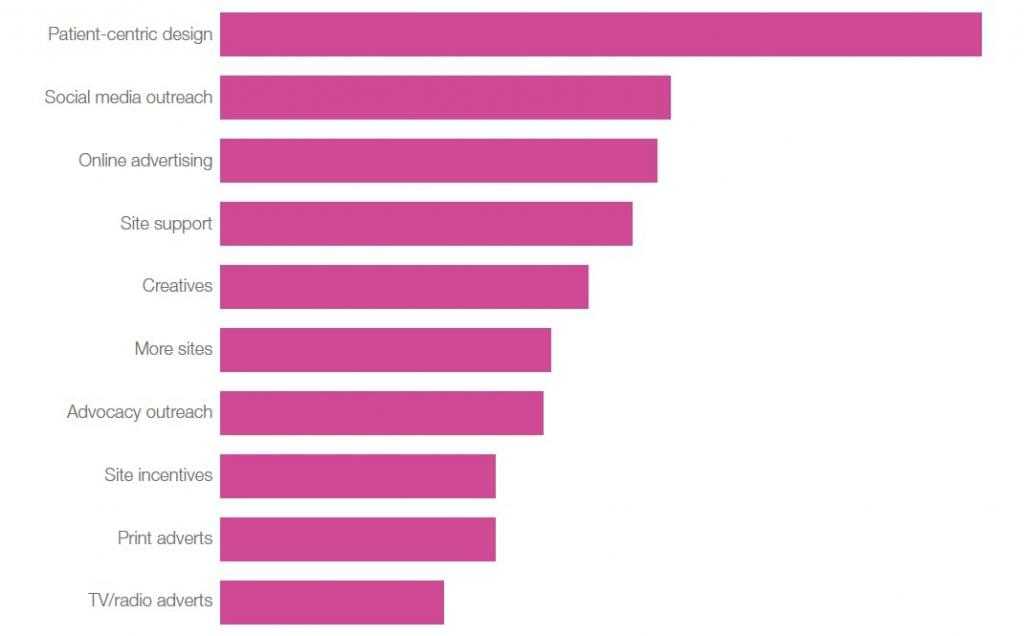

Patient-centric design was followed by social media outreach, online advertising, and site support as being the most cost-effective recruitment strategies. Interestingly, industry respondents rank the increase in trial competition and the growing focus on patient-centricity as the top two drivers for more challenging recruitment. This is followed to a lesser degree by the shift to online and digital outreach and engagement, increased protocol complexity due to more clearly defined patient populations, and technology. Ultimately, the drivers of more challenging recruitment are also perceived to be opportunities for overcoming limited patient recruitment budgets.

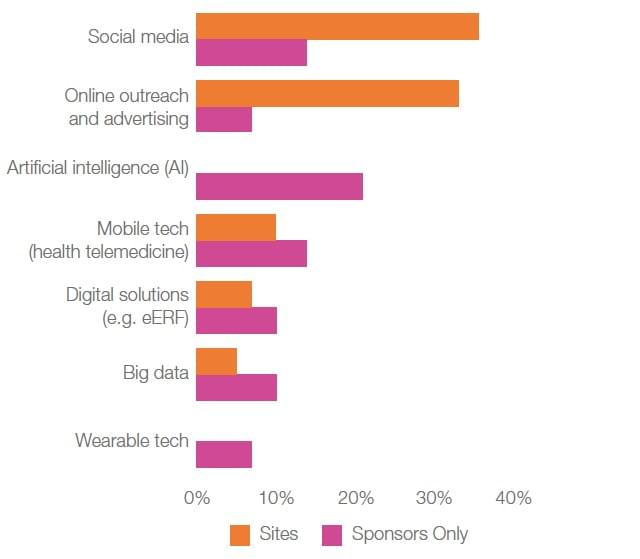

As an example of this challenge/opportunity dichotomy, while a move towards technology-based patient recruitment solutions is creating some difficulties, technology is also seen as bringing innovative advancements to study enrollment. In particular, investigators anticipate social media and online outreach as being the technologies to watch for breakthrough innovation (Figure 2).

Figure 2. Technologies to watch for breakthrough innovation

What support is needed by recruitment services to help turn challenges into opportunities?

With patient-centric design leading the way for cost-effectiveness, it is not surprising that patient-centric solutions are a key requirement of those industry respondents seeking recruitment services (Figure 3). As expected, digital support such as help with online advertising, is also high on respondents’ criteria for recruitment support.

Figure 3. What should a patient recruitment provider offer industry?

Investigators are looking for different types of patient recruitment support. They want sponsors to provide individual advertising budgets and to contract recruitment vendors for external participant referrals. They also want help reducing the complexity of protocol design by the provision of patient-facing materials that will support the consent and enrollment process. Staff resources and training and education also wouldn’t go amiss.

What else did we find?

In summary, investigators and industry are faced with limited budgets that prevent them investing in successful patient recruitment strategies. Therefore, they want to make the most of the budgets they do have and recognize that patient-centricity is a key way to achieve this. Patient-centricity will address challenges to recruitment, such as complex protocols, raising awareness among patients, and harnessing innovative technologies such as artificial intelligence, social media, and mobile devices to reach patients.