TLDR

- China’s digital ecosystem is advanced, but constrained

- Patient trust remains physician-centered, limiting digital-only conversion

- Enrollment pathways are institutionally mediated within hospital systems

- A hybrid recruitment model that integrates digital precision with local medical infrastructure delivers measurable results

Challenges in digital patient recruitment in China

For decades, the US dominated the global clinical trial activity. But that balance is shifting. The World Health Organization clinical trial registry platform shows that while US still leads in cumulative trial registrations since 1999 (197,090), China has rapidly narrowed the gap (163,704). In 2024, China listed more trials than the US – 7,100 compared to 6,000. At the same time, 37% of newly licensed molecules are projected to originate from Chinese biopharmaceutical innovation.

China is no longer a secondary market in global drug development. It is shaping a competitive landscape. But with rising trial activity comes intensified competition for patients. Sponsors increasingly look to digital channels to scale recruitment in a market known for its technological sophistication.

Yet in practice, digital patient recruitment in China is far from straightforward.

Challenge 1 – The digital paradox: Advanced but restricted

China’s digital infrastructure is massive and still expanding. With over 1.1 billion internet users, internet penetration stood at around 80% in 2025. The country’s ecosystem is built around domestic platforms including WeChat (1.4 billion monthly users), Douyin (1 billion+ monthly users), Weibo (470 million monthly users), Baidu, Zhihu (140 million monthly users), and Douban among others.

On the surface, this digital maturity seems ideal for scaling patient recruitment. However, China’s digital ecosystem presents a paradox: it is digitally advanced but operationally constrained for clinical recruitment.

Unlike Western markets where sponsors can leverage global advertising networks like Google and Facebook for precise audience (re)targeting, and cross-platform tracking, China’s internet is dominated by domestic platforms that operate within tightly controlled environments. Major Western platforms are inaccessible within China’s Great Firewall, requiring recruitment teams to adapt campaigns and advertisements to local apps, often with limited third-party tracking and optimization tools.

The digital landscape in China is also shaped by stringent data protection and consent requirements under the Personal Information Protection Law (PIPL), which enforces strict rules on the processing, storage, and transfer or personal information. In the clinical recruitment context, this means that any digital form, pre-screening tool, questionnaire or engagement widget that gathers even basic patient data must be designed to meet these requirements before launch.

At the same time, advertising policies add to another layer of complexity. Health-related messaging is subject to strict review and content controls, requiring approvals or modifications before publication.

Even though digital channels in China offer enormous reach for awareness, the infrastructure available to sponsors does not offer the same level of targeting flexibility, ad optimization and data flow seen in other regions.

Challenge 2: The trust gap in digital-only recruitment

Even when digital campaigns successfully generate awareness, converting that awareness into actual clinical trial participation remains a significant hurdle, and in China it is shaped by culture, language, behavior, and trust dynamics that differ from Western markets.

Asian markets are known to have a lower patient awareness and understanding of clinical trials, compared to other regions. In China’s healthcare culture, trust is physician centered. Many studies on patient behavior in Asia underscore that patients rely heavily on their doctor’s recommendations when making decisions. This extends to clinical trial participation: patients are far more likely to consider joining a study when it is recommended or endorsed by medical professionals they trust, rather than based on an advertisement or online outreach alone.

A 2024 study in Frontiers in Public Health found that 61.1% of respondents had qualified awareness of clinical trials, while 52.9% were willing to participate; among those willing, trust in doctors was a commonly cited reason.

Digital health engagement does not automatically strengthen trust. Online campaigns in China may generate high levels of impressions, clicks and even early engagement, however, conversion rates from digital interest to pre-screening completion and physical site attendance tend to underperform relative to Western benchmarks.

Challenge 3: The gatekeeper effect: When access is mediated

Given that patients are informed, interested, and are willing to participate, enrollment in China still may not be accessible. China’s clinical trial ecosystem is deeply hospital centric that concentrate patient volume, investigator authority and trial activity. Unlike decentralized recruitment models seen in many Western markets, most trials in China remain site-driven and investigator led.

In many cases:

- Sites usually prioritize patients already within their hospital network

- External (digital) referrals require manual review and longer timelines

- Integration of recruitment and hospital platforms are limited

As a result, even highly qualified digital leads may not move forward immediately, not because patients lack trust, but because pathways are controlled by institutional workflows. Without alignment between recruitment strategies and hospital-level processes, leads may stall, regardless of patient interest.

A final word

This is precisely why digital-only strategies often underperform in China. Success in China requires more than digital reach. It requires integration between online engagement and trusted medical infrastructure to fully bring in the success for digital patient recruitment in China.

The Clariness hybrid model: Designed for China’s complex recruitment landscape

China is not a market where global recruitment playbooks can simply be replicated. It requires a model that: understands platform ecosystems, respects regulatory frameworks, recognizes physician-centered trust and integrates with hospital-centric systems. The Clariness hybrid approach is built around these realities, combining digital precision with trusted local execution to drive sustainable enrollment outcomes.

We support you across the full recruitment cycle in China, including feasibility, patient recruitment, and localized creatives development. Our model integrates five critical pillars:

- Network of medical professionals – We collaborate with healthcare professionals on the ground to inform, educate and connect patients with relevant clinical trials, reinforcing digital outreach with trusted medical validation.

- Partner organizations across major cities – Through 20+ partnerships with medical organizations across China, we align recruitment efforts with institutional workflows and site-level processes.

- Local databases and our own private in-country portal – We leverage local databases, our private in-country patient portal, and established presence on Chinese platforms such as WeChat to generate and manage patient engagement within China’s ecosystem.

- Boots on the ground – With a dedicated local office and experienced on-the-ground team in China, we ensure direct market oversight, cultural fluency, regulatory alignment, and close collaboration with sites and partners.

- Public engagement initiatives – We strengthen trial awareness and informed participation within local communities, improving patient readiness and accelerate conversion from interest to enrollment.

If digital patient recruitment in China is constrained by ecosystem limits, behavioral dynamics and institutional gatekeeping, then digital alone is not enough. Our approach is designed to operate within those constraints, not against them.

Take a look at our case studies below:

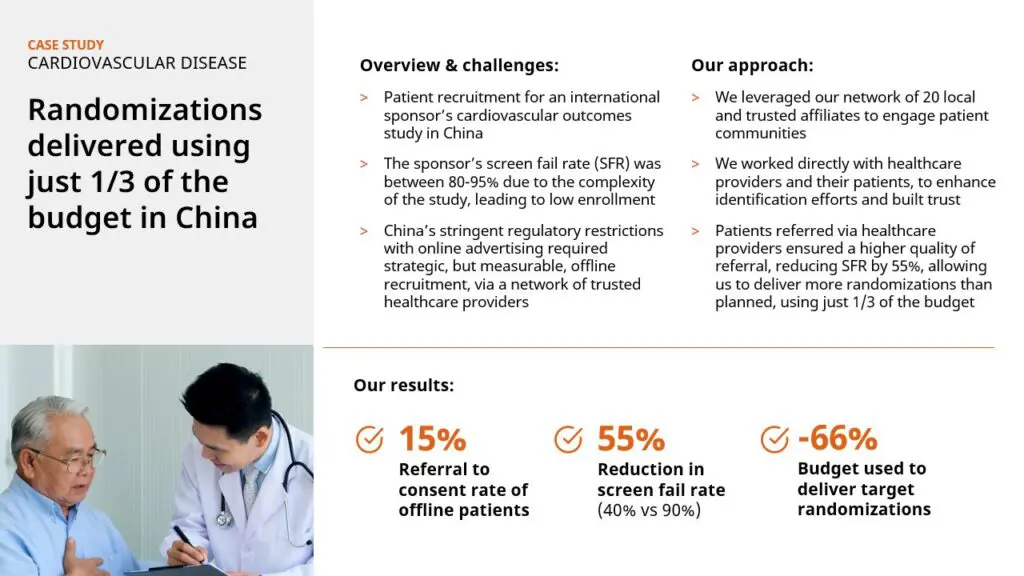

Case Study 1: Randomizations delivered using just 1/3 of the budget in China

Case Study 2: Rapid Rare randomizations delivered in just 6 weeks in China

Having supported 40+ trials since 2019 in China across multiple indications, we have seen firsthand how recruitment performance depends on structural alignment. Across therapeutic areas, the same pattern emerges when digital outreach is embedded within trusted medical networks and institutional workflows, enrollment accelerates, screen failures decline and cost efficiency improve.

China rewards models that are locally integrated, not digitally isolated. Partner with Clariness to design a recruitment strategy that integrates digital precision with trusted local execution, with proven delivery across 60+ countries across 6 continents.

Planning a study in China? Or have one underway that needs support?

Author: Mercy Hapsiba, Content Marketing Specialist | Post Date: 17.02.2026